NiSource Inc. (NYSE: NI) is a utility company that provides natural gas and electricity to millions of customers in the United States. The company operates regulated utilities across several states, ensuring stable revenue streams and reliable services. With a strong focus on infrastructure development and sustainability, NiSource has positioned itself as a key player in the energy sector.

A Unique Seasonal Pattern in NiSource Stock

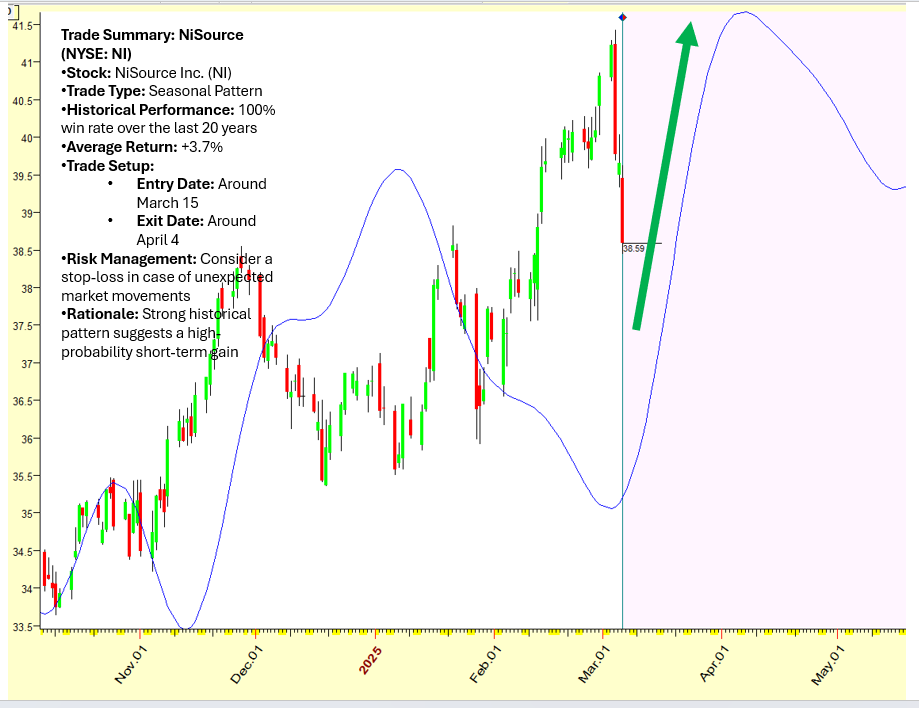

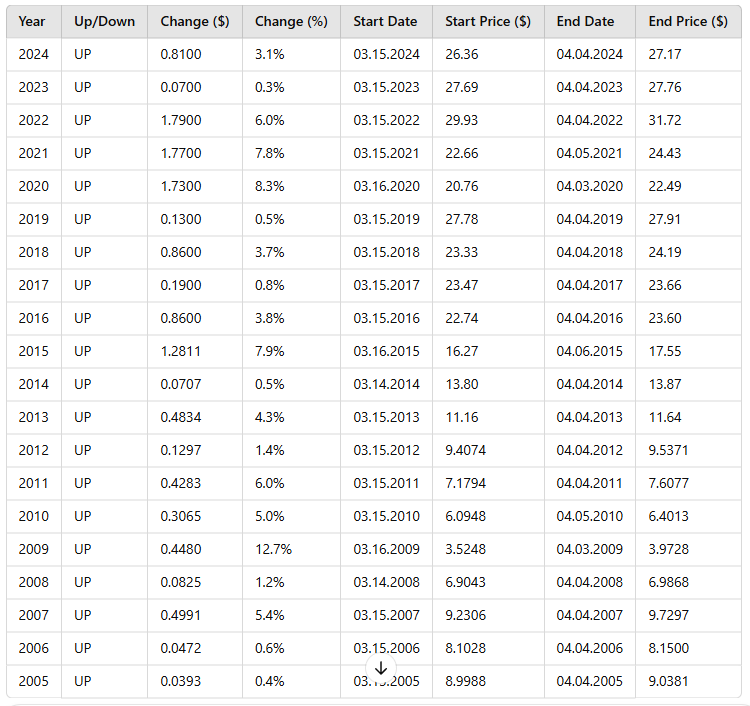

Historical data reveals an exceptional seasonal trend in NiSource’s stock performance. Over the past 20 years, the stock has consistently risen between March 15 and April 4. This means NiSource has had a 100% win rate during this period, an incredibly rare and noteworthy pattern. On average, the stock has increased by 3.7% in these three weeks.

How to Trade This Opportunity

For investors looking to capitalize on this trend, a simple trading approach could be:

- Entry Point: Buy NiSource shares around March 15.

- Exit Point: Sell the shares around April 4.

- Risk Management: While historical trends are promising, it’s always advisable to use stop-loss orders in case the market behaves unexpectedly.

Since NiSource is a relatively stable utility company, the risk associated with this trade is lower than in more volatile sectors. However, as always, investors should consider overall market conditions before making any decisions.

Final Thoughts

While past performance does not guarantee future results, a 20-year streak of positive returns is difficult to ignore. For those interested in seasonal trading strategies, NiSource presents an interesting short-term opportunity worth considering.

Leave a Reply