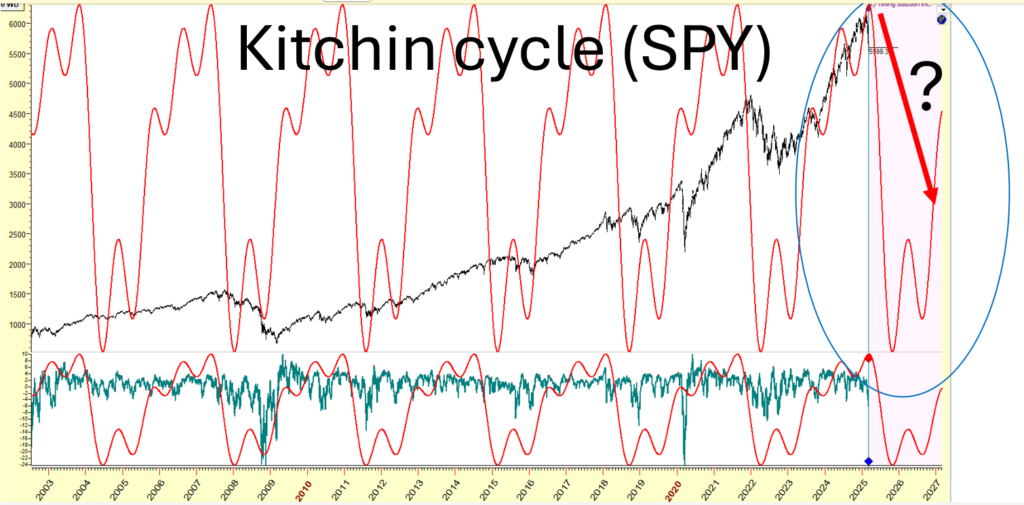

As a trader, I always keep an eye on market cycles, and one that has caught my attention for years is the Kitchin Cycle. It’s a roughly 40-month economic rhythm, often linked to inventory cycles and short-term business fluctuations. While not perfect, history shows that it has been a pretty good guide for spotting bear markets and major corrections. Some cycle lows were brutal, others more manageable, but the pattern is there.

Right now, what worries me is that we’ve passed the peak of the current cycle and are heading into the downturn. What does that mean? That’s the big question. Looking at past cycles, things tend to get rough when we enter this phase. Not always a full-blown crash, but volatility picks up, sentiment shifts, and downturns become more frequent.

The real issue is timing. If the pattern holds, the next major low isn’t due until late 2026. That’s a long road down, and if history is any guide, it won’t be smooth. Some downturns will be sharp, others deceptive, but the overall direction is clear. The bigger concern is whether external factors—rate hikes, economic slowdowns, or unexpected crises—turn this cycle into something worse than just a routine correction.

So what’s the move? It’s not about panic, but about preparation. When a cycle like this turns, risk management becomes critical. Holding cash, reducing exposure to weak sectors, and keeping an eye on opportunities for when the cycle finally bottoms out—those are the key things on my radar.

The bottom line? We’re in the early stages of a potentially turbulent period. If you haven’t thought about how to navigate it, now’s the time.

Leave a Reply