NIO Inc. is one of the most well-known Chinese electric vehicle manufacturers, often referred to as a competitor to Tesla. While the company has faced challenges such as supply chain issues and increased competition, it remains a key player in the EV industry. With NIO stock currently trading at relatively low levels, traders and investors are looking for signals that might indicate the next big move.

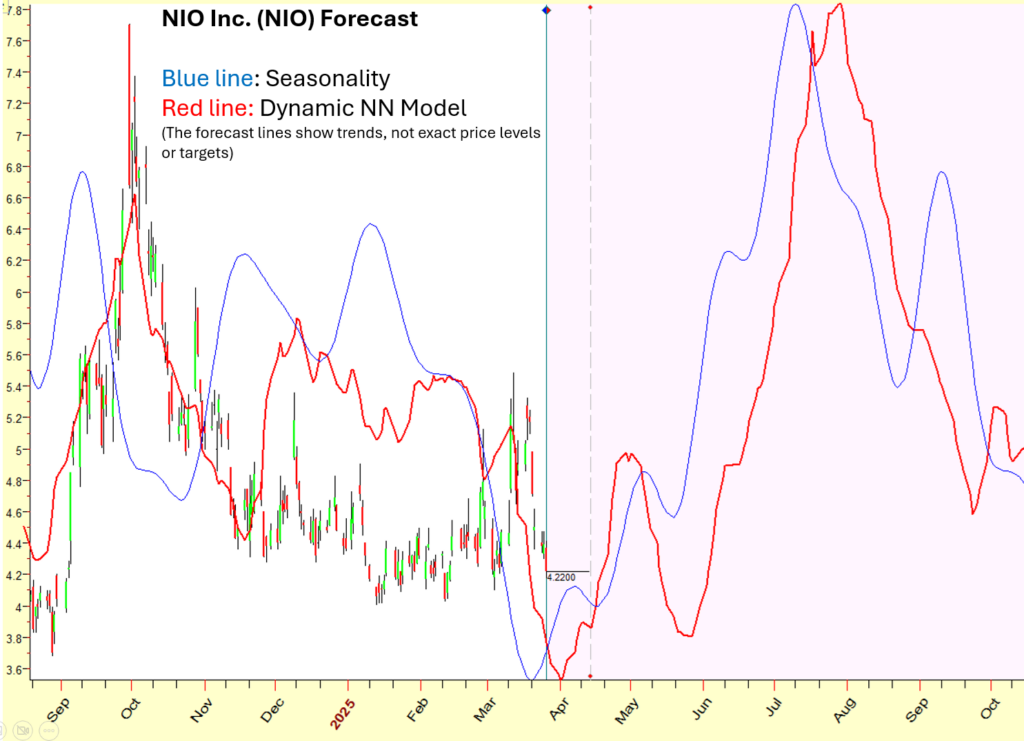

Using the software Timing Solution, I conducted an in-depth analysis focusing on seasonality and a dynamic model based on a neural network. These tools help identify potential turning points in the stock’s price movement based on historical data and predictive analytics.

Key Observations from the Analysis

We are currently at a very interesting point in NIO’s price development. Here’s what the analysis suggests:

- Seasonality Indicator (Blue Line)

- The seasonal trend suggests we are entering a bullish phase right now.

- Historically, this period has been favorable for NIO stock, increasing the likelihood of an upward move.

- Neural Net Model (Red Line)

- The model shows a significant low occurring at the beginning of April, which could indicate a buying opportunity.

- From this low, a bullish phase could extend until around May 1st.

- However, after May 1st, we might see a short-term pullback.

- Critical Date: May 23rd

- Around this date, both the seasonality and the neural network model align, which historically suggests the strongest potential for a sustained rally.

- This alignment increases the probability of a significant move upward, making it a key date to watch for traders.

Important Notes

It’s crucial to understand that the two lines in the chart are not scaled to price levels, but rather indicate potential directional movements. This means the models do not predict exact prices but instead provide insights into likely trends.

Risk Disclaimer

Trading stocks, especially volatile ones like NIO, carries significant risks. While historical patterns and predictive models can offer valuable insights, they are not guarantees of future performance. External factors such as economic news, earnings reports, and broader market conditions can override these patterns. Always perform your own research and consider risk management strategies before making any trading decisions.

Leave a Reply