General Motors Company (NYSE: GM) stands as a cornerstone in the global automotive industry, renowned for its diverse vehicle lineup and innovative strides in electric vehicles (EVs). The company’s stock has experienced fluctuations influenced by market dynamics, industry shifts, and internal developments. In this analysis, we explore GM’s potential stock movements through advanced modeling techniques.

Technical Analysis Using Timing Solution Software

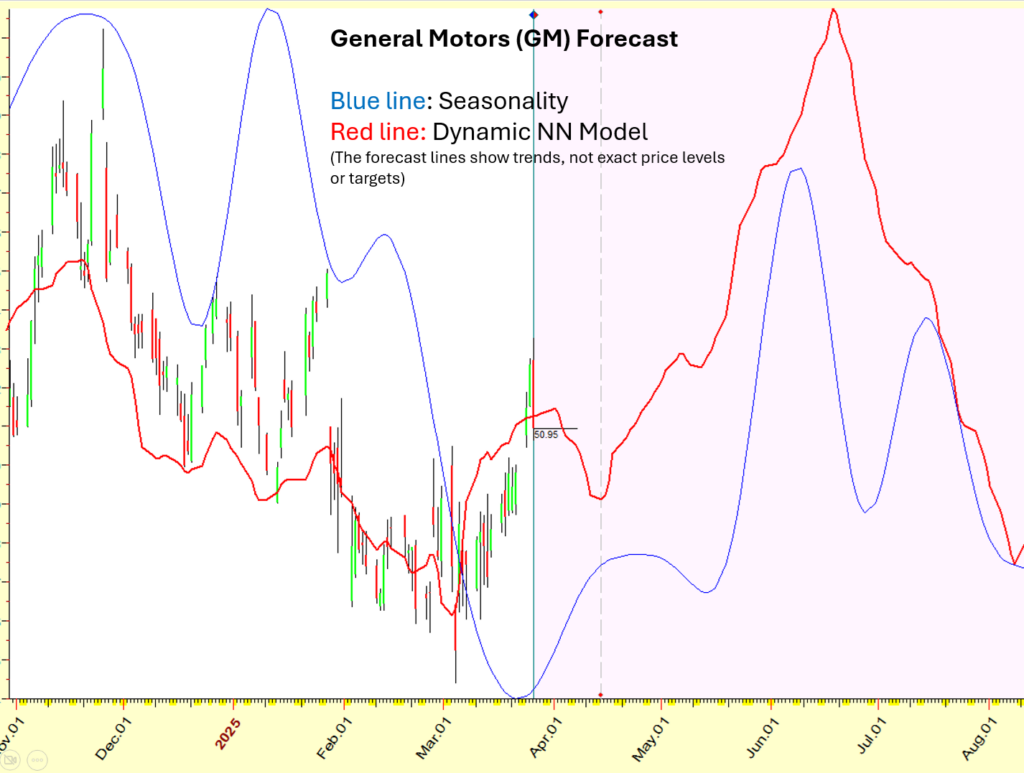

Utilizing Timing Solution software, I examined seasonality patterns and a dynamic model employing Neural Network analysis to forecast GM’s stock trajectory. These methodologies aim to uncover statistical tendencies that may impact future price movements.

Key Observations:

- Seasonality Indicates a Bullish Phase The blue line in the analysis represents seasonality, reflecting historical performance trends of GM’s stock. Currently, the stock is entering a bullish seasonal phase, suggesting a period where GM’s stock has historically shown strength.

- Neural Network Model Suggests a Short-Term Pullback The red line, depicting the Neural Network dynamic model, forecasts a potential short-term retracement until mid-April. This indicates a possible dip before any sustained upward movement, advising caution for traders seeking immediate gains.

- Strong Bullish Setup from Mid-May A notable insight from this analysis is the alignment of both models starting May 15. This concurrence suggests an increased likelihood of a rally. When independent models align directionally, it bolsters the confidence in a significant price movement.

Important Note on the Models

It’s crucial to recognize that the seasonality and Neural Network lines are not scaled to specific price levels. They function as directional indicators, highlighting potential trends rather than exact price targets.

Risk Disclaimer

This analysis is intended for informational purposes only and does not constitute financial advice. Stock markets are inherently volatile, and historical patterns do not guarantee future outcomes. Investors should conduct thorough due diligence and consult with financial professionals before making investment decisions.

Conclusion

GM’s stock is approaching a pivotal juncture. While seasonal patterns point towards bullish momentum, the Neural Network model cautions of a potential short-term decline. The optimal risk-reward scenario appears to emerge after May 15, when both models align favorably. Investors and traders should monitor price movements closely as this period approaches.

Leave a Reply