Tesla (TSLA), the electric vehicle powerhouse led by Elon Musk, has been a rollercoaster for investors lately. Its stock price has seen some sharp ups and downs, and as of late March 2025, it’s got everyone wondering what’s next. I’ve taken a closer look at TSLA’s price direction using Timing Solution software, and the forecast is pointing to an intriguing possibility: a potential rally in the short term. Let’s break it down.

Digging into the Forecast

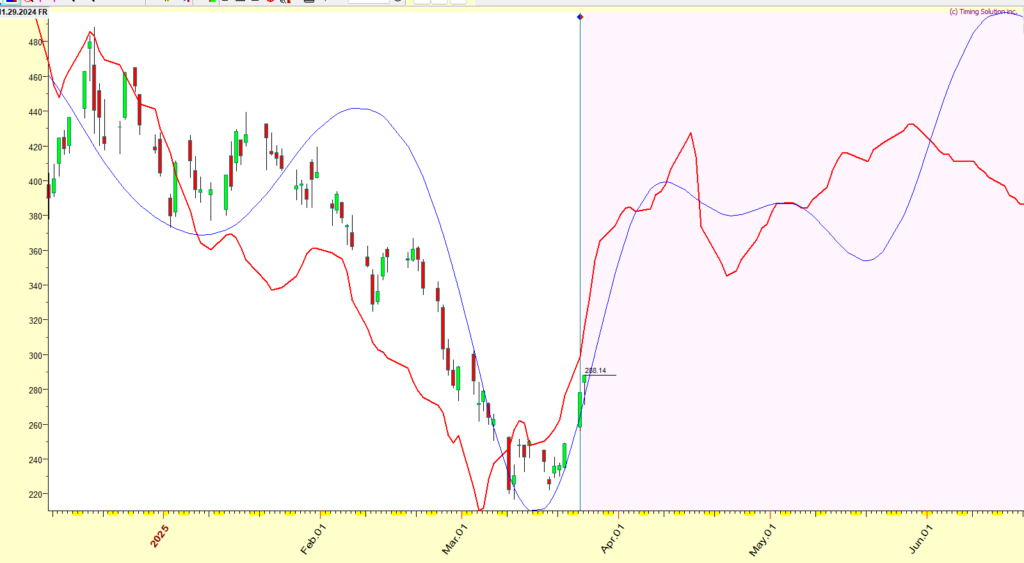

Using Timing Solution, I analyzed Tesla’s stock with two tools: seasonality trends and a dynamic neural network model. The seasonality factor, shown as a blue line, tracks historical patterns and is currently trending upward. This suggests that, based on past behavior, Tesla’s stock tends to rise around this time of year. Meanwhile, the neural network model—represented by a red line—uses advanced calculations to predict price direction. It’s also showing an upward trajectory, with rising prices expected through at least April 15th.

To be clear, these lines don’t predict exact price targets like $350 or $400. They’re not scaled for specific values but rather indicate direction—think of them as saying “prices are likely to head up” rather than pinning down a number. What’s exciting is that both indicators are aligning right now, suggesting Tesla could see a meaningful price increase over the next few weeks.

Why This Could Mean a Rally

Tesla’s stock has been volatile lately, bouncing around after some wild swings. But with seasonality and the neural net model both signaling “up,” we might be on the cusp of a short-term rally. If the forecast holds, TSLA could climb steadily through mid-April, offering a window for investors or traders to capitalize on. Given Tesla’s knack for big moves, this could be a notable jump if momentum kicks in.

Risk Reminder

Of course, no forecast is a sure thing. Tesla’s stock can be unpredictable, driven by everything from production news to Elon Musk’s latest comments or broader market shifts. While the data looks promising, it’s not foolproof. Past trends and models don’t guarantee future gains, so it’s critical to do your own homework and weigh the risks before making any moves.

The Bottom Line

Right now, Tesla’s price outlook is worth watching. The seasonality trend and neural network model both point to rising prices through mid-April, hinting at a potential rally. For anyone following TSLA, this could be a key moment to keep on your radar—just don’t jump in blind. Stay cautious, but if the stars align, we might see Tesla’s stock take off again soon.

Leave a Reply