1. Market Context

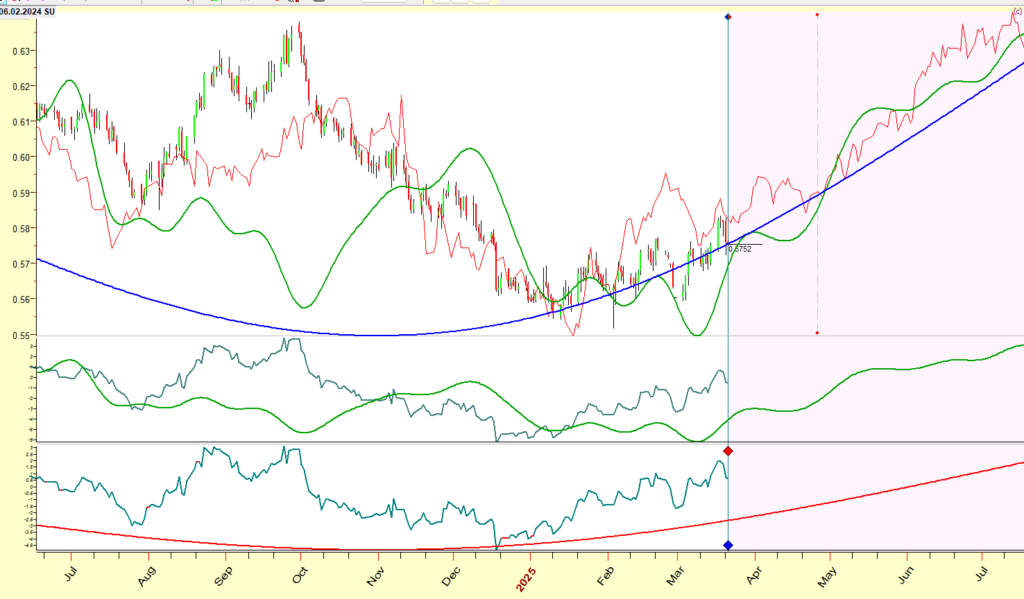

NZD/USD has shown signs of a potential bullish reversal, supported by positioning data, cyclical analysis, and intermarket correlations. Given these factors, I am looking to enter a long position using a structured approach.

2. Key Factors Supporting the Trade

| Factor | Details |

|---|---|

| COT Data | Commercial traders are at their highest long positioning since 2016, indicating strong institutional demand. |

| Cycles Analysis | Several cycles align for a bullish move: – 🟢 Venus synodic cycle (Green Line): Currently turning bullish. – 🔵 8.1-year cycle (Blue Line): Indicates a major long-term bottom has formed. – 🔴 Intermarket analysis (Red Line): Based on corn (145-day lag), signaling strength in NZD. |

| Technical Analysis | The price is stabilizing above key support levels, aligning with the long-term cyclical bottom. |

| Other Factors | Seasonal strength in NZD and potential shifts in risk sentiment could further support the trade. |

3. Entry Strategy: 18-Bar Entry Technique

I am using Larry Williams’ 18-bar entry technique, which provides a systematic way to enter trends:

- Wait for two consecutive daily lows above the 18-day simple moving average (SMA). This confirms that price is sustaining above the moving average rather than just briefly crossing it.

- Enter long when the price exceeds the highest high of those two bars. This acts as a momentum confirmation.

- Stop-loss placement: Below the lowest of the two setup bars or an 18-bar exit signal.

This method helps avoid false breakouts and ensures that the trade aligns with a confirmed uptrend.

4. Trade Management

- Stop Loss: Below the setup bars or an 18-bar sell signal.

- Profit Target: 0.6250 (first resistance), 0.6400 (longer-term target).

- Exit Conditions: A close below the 18-day SMA for two consecutive days or a breakdown in cycle alignment.

5. Risk Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Trading involves significant risk, and past performance is not indicative of future results. Always conduct your own research before making investment decisions.

Leave a Reply