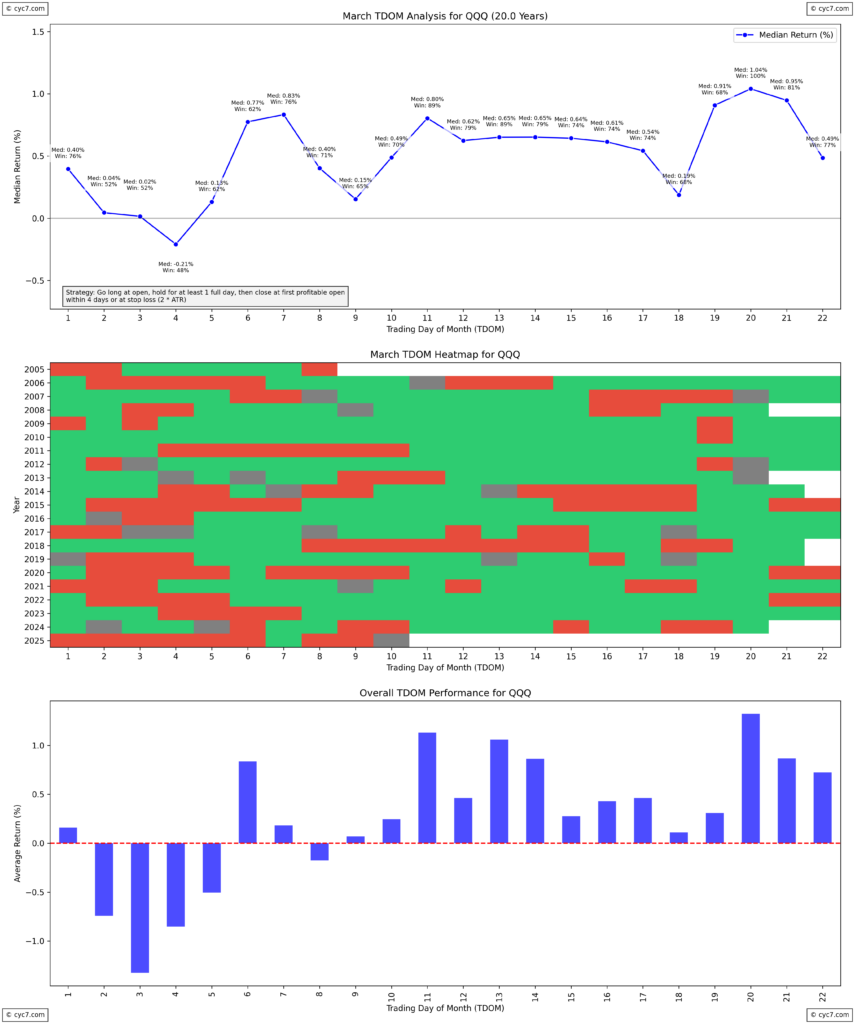

The Trading Day of the Month (TDOM) strategy, developed by Larry Williams, analyzes returns by trading days rather than calendar days. This approach uncovers repeatable market patterns, giving traders an edge over traditional monthly analysis.

Backtest Setup

We backtested 20 years of March data for QQQ (Invesco QQQ Trust, tracking the Nasdaq-100) with these rules:

- Entry: Go long at market open.

- Exit: Hold for one day, exiting on the first profitable open within four days.

- Risk Management: Use a 2 ATR stop loss (ATR = Average True Range, a volatility measure).

Observations & Key Findings

- First Five Trading Days: Weak returns and low win rates dominate early March for QQQ.

- Trading Day 6 Onward: Performance improves, with more positive days.

- Trading Day 11 – A Key Turning Point: Strong returns and high win rates emerge here. In 2025, this falls on March 17—watch Monday’s open!

- Seasonal Bullish Phase: Mid-March kicks off a rally lasting until month-end.

- Strongest Trading Days: TDOM 11-14 often deliver the best gains in QQQ.

Conclusion

March follows a clear pattern for QQQ: a shaky start, then a bullish surge from TDOM 11 onward. As of March 15, 2025, we’re nearing this shift. Test it yourself—will history repeat for the Nasdaq-100? Past performance isn’t a crystal ball, so trade smart.

Risk Disclaimer: Trading is risky and not for everyone. Historical trends don’t guarantee future wins, and markets can flip fast. Always manage risk and talk to a pro before jumping in.

Leave a Reply